By Frank Esposito

SENIOR STAFF REPORTER

Published: May 28, 2014 3:54 pm ET

Updated: May 28, 2014 3:58 pm ET

Image By: Rich Williams

It’s not even June and Dow Chemical boss Andrew Liveris already has had one heck of a year in 2014.

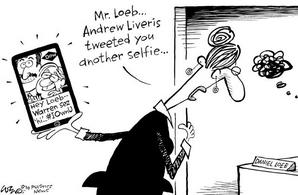

Things got rolling for Liveris on Jan. 21 when activist investor Daniel Loeb and his Third Point LLC hedge fund blasted Midland, Mich.-based Dow in a letter to investors for what was described as “a poor operational track record across multiple business segments.” Loeb and Third Point also called for Dow — one of the world’s largest plastics and chemicals makers — to be split into two separate companies, with its petrochemicals business in one.

Within days, Liveris — a 38-year Dow veteran who’s occupied the corner office since 2004 — had met with American business guru Warren Buffett – whose Berkshire Hathaway firm is a Dow shareholder. Buffett assured Liveris that Dow was heading in the right direction.

Liveris, naturally, didn’t keep Buffett’s assurances to himself. He took to the airwaves Jan. 29 on CNBC’s Squawk Box program to share that info with viewers around the world.

On the show, Liveris said that Buffett had told him that “We’re an owner and we like being an owner,” adding that “we think [Liveris] has been running the company for the investors who will stay vs. investors who will leave.”

Somewhere in New York, Loeb had to wince at those words. Liveris had to feel like a happy pastor who just had the Pope show up at his church’s bake sale.

(This, by the way, is probably not the first time that Warren Buffett has been compared to the Pope.)

CNBC’s website wrote about Liveris’ appearance under the headline, “Hey Loeb, Buffett has my back.” On that same date, Dow — one of the world’s largest plastics and chemicals makers —announced that full-year profit for 2013 grew more than four times to $4.8 billion. Part of that increase was a $2.5 billion settlement from a Kuwaiti firm over a failed business deal in 2008.

In a Q&A session with analysts, Liveris didn’t mention Loeb or Third Point by name, but he did say that he “agreed with the investor that there is an upside” to Dow’s strategy. Liveris also defended his firm’s strategy, saying that “no one else can imitate the Dow business — there’s only one competitor in similar businesses, and they value their business as much as we do.” And he pointed out that Dow already had sold off $10 billion of assets in recent years and in late 2013 announced plans to sell off $5 billion more.

Dow’s plans to increase its share buyback program and to sell off other small businesses was seen by some as a response to Loeb’s criticism. Company officials said these moves were part of an existing strategy. And like other firms in the region, Dow has announced plans to add polyethylene and ethylene capacity to take advantage of newfound supplies of shale-based natural gas.

(This spat with Loeb and Third Point also resulted in one of the year’s best headlines, when the Motley Fool financial website analyzed the situation in an article titled “The Dow Chemical Company Prepares to Unveil Its Beach Body.” It’s going to be difficult for plastics and chemicals publications to top that one. Unless a company like BASF or DuPont sponsors a bikini contest.)

Image By: Plastics News file

Esposito

Liveris was able to deliver more good news for Dow on April 23, when the firm announced that first-quarter 2014 profit was up more than 60 percent to just under $1.1 billion, even though sales essentially were flat at almost $14.5 billion.

In a news release on that date, Liveris said that Dow “will continue to execute aggressive portfolio management and to release additional value through the monetization of non-strategic businesses.” Which means they’re looking for buyers for the businesses they said they wanted to sell in late 2013, including some chlorine-related units that are among the firm’s oldest legacy businesses.

What has Dow’s per-share stock price been doing amid all this hubbub? Well, it was around $43 before being goosed by the Loeb letter in late January. It proceeded to shoot up above $50 in late March before settling down a bit to close near $49.30 on May 19. So much for the market’s fabled dislike of uncertainty.

So do the higher profits and stock price mean that Liveris can relax a little? Maybe take in a baseball game at Dow Diamond in downtown Midland, where the minor-league Great Lakes Loons play? Have some peanuts and Cracker Jack and sing “Take Me Out to the Ballgame” during the seventh-inning stretch?

That might happen. Then again, it might not. Because on April 30, Loeb and Third Point fired another shot across Dow’s bow. This time – according to a letter to investors that was obtained by Reuters – Loeb said that Dow’s integrated strategy is costing shareholders billions, and that the firm’s executives should work harder to boost results and transparency.

To date, Dow has declined to comment on Loeb’s most recent comments. For Andrew Liveris and Dow Chemical, an event-filled 2014 rolls on. |